How to Successfully Dispute Problems on your Credit Report

How to Successfully Dispute Problems on your Credit Report |  |

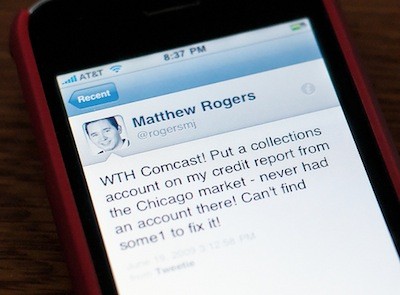

| How to Successfully Dispute Problems on your Credit Report Posted: 30 Nov 2010 04:15 AM PST Credit card companies and credit reporting agencies sometimes make mistakes. Those mistakes can result in costly errors on your credit report, unfairly lowering your credit score and making it difficult for you to get the best loan terms. That's why it is important to monitor your credit reports. When something on them is wrong, you need to file a dispute.

Reasons to Dispute a Credit Report

It is a credit card myth that you can just dispute problems on the report because you don't like that they're there. You have to have a valid reason to file a dispute. Valid reasons include:

Note that it can take as long as 90 days for your dispute to be properly handled so it's best to take this action as soon as you realize that a dispute may need to be filed. How to File a Dispute with the Credit Reporting Bureaus

Typically when you file a dispute you will do so with one or more of the three major credit reporting bureaus (Experian, Equifax and TransUnion). In many cases it makes sense to file the report with all three reporting bureaus because they may all have the same mistaken information. However, in less common instances the problem is only with one bureau and there is no need to contact the others. Continue to monitor the others closely in the months following, though, to make sure that the problem doesn't crop up with them as well. If you're ready to file a dispute with a credit reporting bureau then you need to do the following:

Filing a Dispute with the Credit Card Company

Note that you may want to file a dispute with your credit card company in addition to filing a report with the credit bureau. If your credit card company has reported a problem to the bureaus that is incorrect then it's worth it to do this. Sometimes the company will repair the problem with the credit bureaus before your personal dispute goes through, remedying the credit report more quickly for you. To file a dispute with the credit card company, simply contact them and ask for the fax number or mailing address to file disputes. Write out your dispute and provide any supporting documents to prove your claim. Include relevant information such as your account number. Request in writing that the company contact the credit bureau to repair the problem. Have you ever had to file a credit report dispute? How did the process go for you? What tips do you have for others? Share your experience in the comments. |

| Posted: 29 Nov 2010 09:00 AM PST The nice thing about the personal finance blogosphere is that you can always find a few people who can tell you how to do something. Today, here are some great advice-laden posts that can really help you out — especially as the holiday shopping season kicks in: Cyber Monday Shopping Safety RulesJulia Scott, the Bargain Babe, shows you how to stay safe as you scour the web for deals this Cyber Monday, on Wallet Pop. How to Protect Yourself from Debit Card OverdraftsTisha Tolar at Moolanomy offers an overview of what you can do to protect yourself when it comes to overdrafts with your debit card. 4 Tips to Protect Yourself From Identity TheftKevin at Financially Poor knows that identity theft can be something serious. Here are four ways to protect yourself. How to Save MoneyFrugal Zeitgeist jumps right in with some very helpful advice on how you can save money. Quite useful right now, as the holiday season encourages us to spend, spend, spend. How to Find Your Absolutely, Positively REAL and TRUE FICO Credit Score. Seriously.Jeff Rose offers a look at what it takes to find your true credit score at Good Financial Cents. Other Financial PostsHere are a few more useful and insightful financial posts from around the web:

|

| You are subscribed to email updates from Financial Highway To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home